Regardless of the rising chatter of an AI bubble, Sequoia Capital insists its funding method is unswayed by the market frenzy.

“Markets go up and down, however our technique stays constant. We’re all the time searching for outlier founders with concepts to construct generational companies,” mentioned Bogomil Balkansky, a associate on Sequoia’s early-stage funding workforce.

To show this consistency, Sequoia introduced two new funds on Monday that just about match the sizes launched about three years in the past: a $750 million early-stage fund concentrating on Collection A startups and a $200 million seed fund.

These funds are launched after what has been a tumultuous interval for the legendary agency. In 2021, Sequoia overhauled its construction into an evergreen foremost fund supported by strategy-specific “sub-funds,” primarily to allow the agency to retain inventory in portfolio firms lengthy after their IPO. The agency took a major monetary hit in late 2022, shedding over $200 million when its funding in cryptocurrency alternate FTX blew up, adopted by the 2023 separation from its India and China divisions.

The storied agency, which famously backed Airbnb, Google, Nvidia, and Stripe of their infancy, is placing latest challenges behind it and returning to its core objective: investing in promising founders on the earliest levels of creation.

Balkansky bolstered this mission: “Our ambition has all the time been and continues to be to establish these founders as early as potential; to roll up our sleeves and be a really energetic participant of their company-building journey.”

With AI startup valuations skyrocketing, Sequoia desires to make use of the brand new funds to put money into probably the most promising founders in the beginning of their startup-building journey. This technique permits the agency to safe a low value whereas locking in a major possession stake.

Techcrunch occasion

San Francisco

|

October 27-29, 2025

This early-stage focus is much more essential for the agency now. As valuations soar at an unprecedented tempo, getting in early is the important thing to locking in a lower cost and securing a considerable stake.

This method is paying off: Sequoia’s seed and Collection A investments in Clay, Harvey, n8n, Sierra, and Temporal have appreciated manyfold amid the AI growth.

Even with its famend Collection A historical past, Balkansky made it clear that Sequoia goals to defend its legacy by investing even earlier: “We’ve got an incredible observe report and custom to associate with firms on the very earliest stage, which at the moment will likely be categorised as a pre-seed.”

He highlighted the agency’s early conviction: Sequoia just lately wrote the primary examine into safety tester Xbow, AI reliability engineer Traversal, and DeepSeek various Reflection AI — all firms which have since raised vital capital at a lot increased valuations. Among the many methods the agency has helped behind the scenes, it says it recruited a former Databricks CRO to Xbow’s board, linked Traversal with greater than 30 potential prospects, and organized a gathering between Reflection AI and Nvidia’s Jensen Huang, main on to a $500 million funding from the chipmaker.

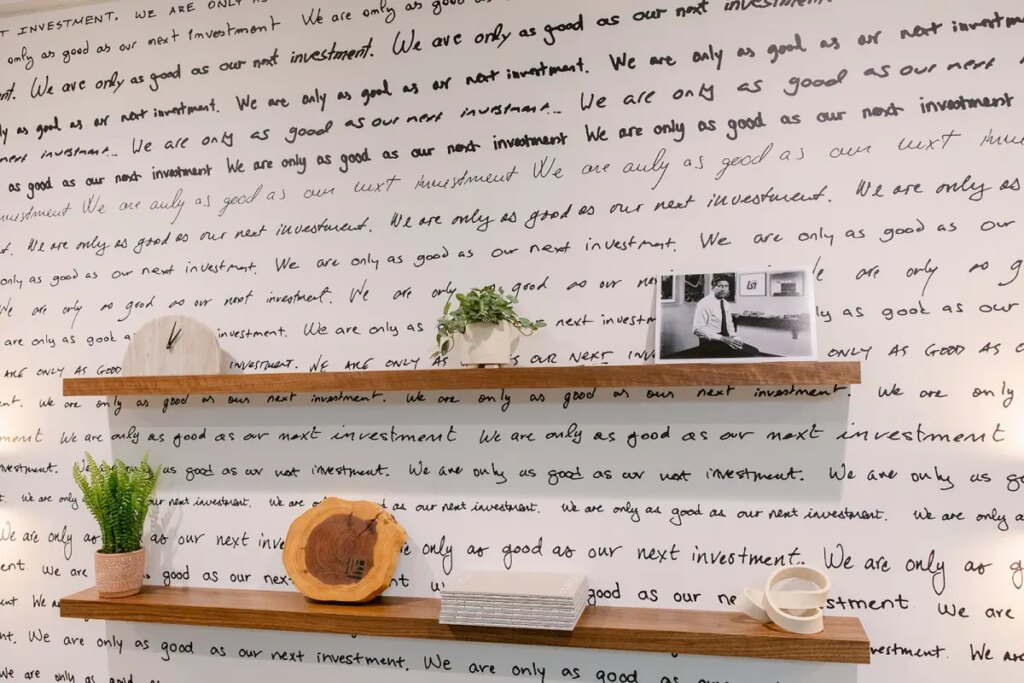

Even with these latest successes, Sequoia is relentlessly targeted on upholding its five-decade legacy as Silicon Valley’s high investor. To make sure this mindset persists, the agency’s newly renovated workplace contains a wall the place each investor handwrote this reminder: “We’re solely nearly as good as our subsequent funding.”

{content material}

Supply: {feed_title}