Here’s a rewritten version of the article, aiming for 100% uniqueness, an engaging tone, and the specified structure:

***

## The Federal Reserve’s Pivotal Pause: Navigating Inflation and a Shifting Job Market

As the Federal Reserve convenes for its inaugural meeting of the new year this Wednesday, market observers and economic analysts are poised for a significant announcement: a likely decision to maintain current interest rates. This anticipated pause comes as central bank officials grapple with a delicate balancing act, contending with persistent inflation that remains stubbornly high while simultaneously monitoring a labor market that shows signs of cooling.

### A Moment of Stasis for Monetary Policy

The Federal Open Market Committee (FOMC), the Fed’s primary policymaking body, is widely expected to keep its benchmark federal funds rate target unchanged within the 3.5% to 3.75% range. If confirmed, this would mark the first time the central bank has held rates steady since the summer of 2025, following a series of three consecutive 25-basis-point cuts enacted during the latter half of 2025. These previous adjustments were part of a broader cycle that saw 175 basis points slashed since September 2024, bringing rates down from a cyclical peak of 5.25% to 5.5%.

## A House Divided: The Internal Debate on Rate Cuts

The path to this expected pause has been anything but unified. Minutes from the last Fed meeting revealed significant internal dissension among policymakers regarding the appropriateness of further rate cuts. One faction advocated for lower interest rates, arguing such a move would be crucial to “help stabilize the labor market,” which faced increasing uncertainty.

Conversely, a substantial number of officials voiced concern that “progress towards the committee’s 2% inflation objective had stalled.” Some who ultimately voted for the December rate cut suggested that, based on their economic outlooks, it would likely be prudent to keep the target rate unchanged for an extended period after that particular reduction. This internal tussle underscores the complexities of current economic conditions.

### Market Consensus: A Near Certainty

Despite the internal divisions, external market sentiment is overwhelmingly aligned with the expectation of a pause. The CME FedWatch tool, a widely cited indicator, now pegs the probability of rates remaining unchanged at an impressive 97.2%. This figure represents a notable climb from 94.5% just a week prior and a more significant jump from 82.3% recorded last month, signaling a firm consensus among investors.

## The Dual Mandate Under Scrutiny

The Federal Reserve operates under a dual mandate: to foster maximum employment and maintain stable prices, typically defined by a long-term inflation target of 2%. Both pillars of this mandate have been under considerable strain recently, exacerbated by economic headwinds stemming from evolving trade and immigration policies.

### The Persistent Inflation Challenge

Inflation, a key concern for the Fed, continues to hover above its target. The Personal Consumption Expenditures (PCE) index, the central bank’s preferred measure, registered 2.8% in November 2025 – the most recent data available. While this is a decrease from the peak of 9.1% (CPI) seen in June 2022, it still represents a slight increase from the 2025 low of 2.2% observed in April of that year, indicating that price stability remains an ongoing challenge.

### The Shifting Labor Landscape

On the employment front, the picture is equally nuanced. The unemployment rate saw a modest decline from 4.5% in November 2025 to 4.4% in December 2025. However, this recent dip does not erase the broader trend observed throughout 2025, during which the unemployment rate generally trended higher after reaching a low of 4% at the beginning of the year. This suggests a labor market that, while not collapsing, is certainly cooling.

## What Lies Ahead: Powell’s Signals and Expert Projections

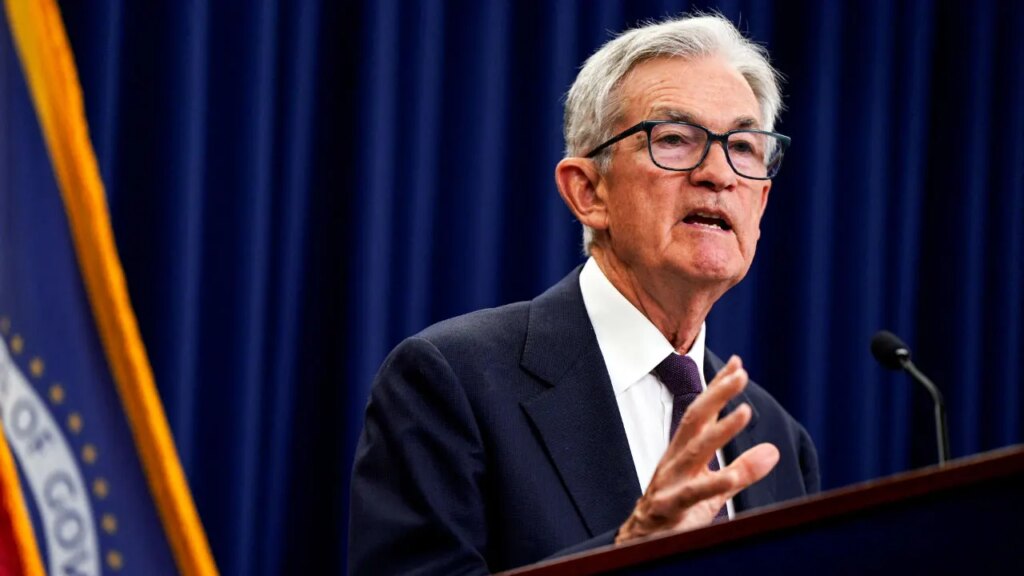

With interest rates now closer to a neutral stance and no immediate signs of a dramatic weakening in the labor market or a re-acceleration of inflation, all eyes will be on Fed Chair Jerome Powell’s post-meeting press conference. Investors will be eagerly dissecting his statements for any clues regarding the potential trajectory of future rate cuts later in 2026.

### Expert Insights: The Road Forward

Economists offer varied but cautious outlooks for the year ahead:

* **Gregory Daco, Chief Economist at EY-Parthenon**, anticipates a total of 50 basis points of easing throughout 2026. He projects that PCE inflation will hover just below 3% in the initial months of the year before gradually receding towards 2.5% by year-end, contingent on a gradual softening of labor market fundamentals. Daco suggests that the first rate cut of 2026 is unlikely to materialize before June.

* **Seema Shah, Chief Global Strategist at Principal Asset Management**, points to a scenario where “inflation is sticky but not accelerating, the labor market is cooling without collapsing, and fiscal stimulus is set to support growth in early 2026.” In this context, she believes policy rates will need to revert to normal levels, but not below. Shah forecasts two rate cuts in 2026, positioning rates just below the midpoint of the neutral range. She emphasizes that timing will remain data-dependent, though a sustained increase in unemployment could potentially accelerate these cuts into the first half of the year.

***

**Summary of Main Points:**

* **Expected Pause:** The Federal Reserve is widely anticipated to hold interest rates steady at its first meeting of 2026 (Wednesday), keeping the benchmark federal funds rate between 3.5% and 3.75%.

* **First Pause Since Summer 2025:** This would be the first time rates remain unchanged since mid-2025, following three consecutive 25-basis-point cuts in late 2025.

* **Internal Division:** Minutes from the last Fed meeting revealed significant disagreement among policymakers, with some advocating for cuts to support the labor market and others concerned about stalled progress towards the 2% inflation target.

* **Strong Market Consensus:** The market overwhelmingly expects a rate pause, with the CME FedWatch tool indicating a 97.2% probability.

* **Dual Mandate Pressure:** Both the Fed’s goals of stable prices (2% inflation) and maximum employment are currently under pressure.

* **Inflation Remains Elevated:** The PCE index was 2.8% in November 2025, above the 2% target, although significantly down from its 2022 peak.

* **Cooling Labor Market:** The unemployment rate declined slightly to 4.4% in December 2025 but trended higher over 2025 from its early-year low.

* **Future Outlook:** Experts foresee potential rate cuts later in 2026, with estimates ranging from 50 basis points (EY-Parthenon) to two cuts (Principal Asset Management), largely dependent on inflation trends and labor market dynamics. The first cut is generally not expected before June 2026.